Frustrated by Tailride’s compliance limitations?

If you’re worn down by weak audit trails and awkward financial system integration, I know exactly why you’re searching for a better way.

Those pains can seriously undermine your compliance confidence when it matters most.

Sticking with Tailride can mean wasted hours on manual workarounds, missed audit markers, and frustrated team members who lose trust in your internal processes. These issues don’t just get in the way—they drain resources, slow down financial audits, and leave you second-guessing every audit cycle.

The good news: there are proven solutions that address these headaches and unlock efficiency gains your team needs.

In this article, I’ll walk you through the best Tailride alternatives for finance teams, including options like FileCenter, SmartVault, DocuWare, and more—each offering security, ERP integration, and workflow automation that Tailride lacks.

Make the right switch to boost audit confidence and streamline compliance.

Let’s explore your options.

Quick Summary:

| # | Alternative | Rating | Best For |

|---|---|---|---|

| 1 | FileCenter → | Users wanting modern interfaces | |

| 2 | SmartVault → | Teams needing better collaboration | |

| 3 | DocuWare → | Companies requiring better support | |

| 4 | Egnyte → | Budget-conscious growing businesses | |

| 5 | GoFileRoom → | Small teams seeking simplicity |

1. FileCenter

Ready for a compliance overhaul in your document management?

FileCenter gives you a familiar interface built around e-file cabinets, offering more visibility and flexibility than Tailride’s restrictive invoice-focused workflows.

Instead of being boxed in by limited automation and tricky integrations, you get robust control over all your finance documents—right on your desktop. Managing diverse financial records suddenly feels much less complicated.

Here’s how FileCenter steps up as a true alternative.

Your team will immediately benefit from easy filing using e-cabinets and drawers that mirror your Windows structure, simplifying adoption and making migration much less painful.

FileCenter solves the financial document headache by giving you a system that feels like working within Windows, but with powerful tools for scanning, OCR, and PDF management layered in.

The advanced scanning engine lets your team digitize paper records with one click, automatically naming files and making every financial statement full-text searchable. No more hunting for files lost in obscure Tailride categories—you can search across all your documents in seconds.

Additionally, having robust PDF editing and creation built-in means you rarely need to jump between different apps. You can annotate, merge, and update PDFs for anything from invoices to audit reports, tying everything together for smooth workflows.

The end result is faster audits, confident compliance, and drastically less time lost wrestling paper.

Key features:

- Familiar e-cabinet and drawer interface organizes your finance documents using well-known Windows folder structures, which slashes migration friction and shortens the learning curve for your team.

- Advanced one-click scanning and full OCR search digitizes and tags all types of financial documents, providing organization and discoverability way beyond Tailride’s invoice-centric system.

- Built-in PDF editing and creation tools let you manage, annotate, and compile audit-ready PDFs internally, eliminating the need to rely on separate editing tools and reducing process gaps.

Verdict: FileCenter is a standout Tailride alternative for finance teams needing flexible document management. Finance users say they’ve reduced a week’s paperwork to just 15 minutes, thanks to the e-cabinet filing, OCR search, and integrated PDF tools—a major win for compliance and productivity if you’re hitting Tailride’s limits.

2. SmartVault

Is your audit readiness still falling short?

SmartVault steps up with true accounting-focused integrations and a client portal built for secure document exchange and automated routing, filling key gaps left by Tailride’s basic features.

Unlike Tailride, SmartVault lets your team streamline document intake, automate compliance, and centralize all client files securely. This means you no longer have to jump between half-baked submission tools and manual uploading to keep your financial records centralized.

Here’s where SmartVault starts to make a real difference.

If you need more than basic invoice capture, SmartVault is built for you.

SmartVault solves the compliance and integration headaches you might encounter with Tailride by providing advanced integration with leading accounting software, a secure client portal, and full audit logs.

You can automate your document workflows with accounting-specific integration to QuickBooks and Lacerte, so files flow from clients to ledgers without manual steps. The secure portal and integrated e-signatures transform client collaboration—your team can request or receive tax, audit, or payroll documents directly while maintaining a complete audit trail.

Additionally, SmartVault’s enterprise-grade security ensures that sensitive statements, contracts, and returns stay compliant and protected. SOC 2 Type 2 certification and granular role-based controls mean you avoid compliance gaps common to less specialized solutions.

The result is bulletproof audit trails and real-time workflow efficiency.

Key features:

- Accounting-focused integrations automate document routing: SmartVault connects with QuickBooks, Lacerte, and UltraTax, enabling direct, secure transfer and categorization of tax and financial documents—far outpacing Tailride’s submission-centric system.

- Branded client portals with e-signature and audit logs: Share and request documents securely from clients, manage e-signatures, and track every action for a complete compliance-friendly audit trail.

- Enterprise-grade security ensures regulatory compliance: Enjoy SOC 2 Type 2 security, granular permissions, and detailed activity logs to demonstrate compliance across all financial document workflows, not just invoices.

Verdict: SmartVault is a strong alternative to Tailride for finance teams craving compliant document management and integration depth. Users report saving thousands each year with unlimited eSignatures and streamlined collaboration, making it a perfect fit if you want robust workflows and bulletproof audit trails, not just basic invoice tools.

3. DocuWare

Tired of struggling with compliance and clunky workflows?

DocuWare brings enterprise-grade document management and automation, letting you overhaul your financial processes in ways Tailride just can’t match.

Forget limitations like Tailride’s basic invoice extraction; DocuWare automatically captures and indexes financial documents with AI and full-text OCR, from contracts to receipts. This means every file is search-ready, accurate, and tagged without manual input.

If you’ve felt exposed by weak audit trails or find that Tailride lacks workflow flexibility, DocuWare delivers advanced compliance controls with customizable workflows and secure archiving. You sidestep gaps that could impact your audit readiness or slow financial operations.

That’s where DocuWare really shines as your Tailride alternative.

DocuWare transforms the way your finance team handles compliance and workflows, solving hidden risks Tailride often leaves behind.

Instead of chasing down files or battling rigid approval flows, your team leverages AI-powered document processing to handle everything from invoices to contracts automatically. All data gets categorized, stored, and ready for audit in just a few clicks—no workarounds or patchy integrations required.

Plus, advanced workflow automation lets you digitize and customize each financial process, so invoice approvals or contract reviews move as fast as you need—without sacrificing security. This not only streamlines routine tasks but ensures your data is protected and always audit-ready.

With DocuWare, you can finally stop worrying about compliance gaps.

Key features:

- AI-driven intelligent document capture and indexing means your receipts, invoices, and contracts are digitized and classified automatically, ensuring more searchable records and less time spent on manual data entry.

- Advanced, customizable workflow automation for finance streamlines everything from invoice routing to contract approvals, empowering your process designers with far more options than Tailride’s template workflows allow.

- Secure archiving and audit trails for compliance give your auditors what they want instantly, with tamper-proof histories and encryption that meet or exceed major finance regulations—keeping your records reliable and protected.

Verdict: DocuWare is a powerful alternative to Tailride when your finance team needs true document security, advanced automation, and real audit readiness. Users report saving over 8 hours per day through automation—resulting in both faster payments and dramatically improved efficiency across all critical finance records.

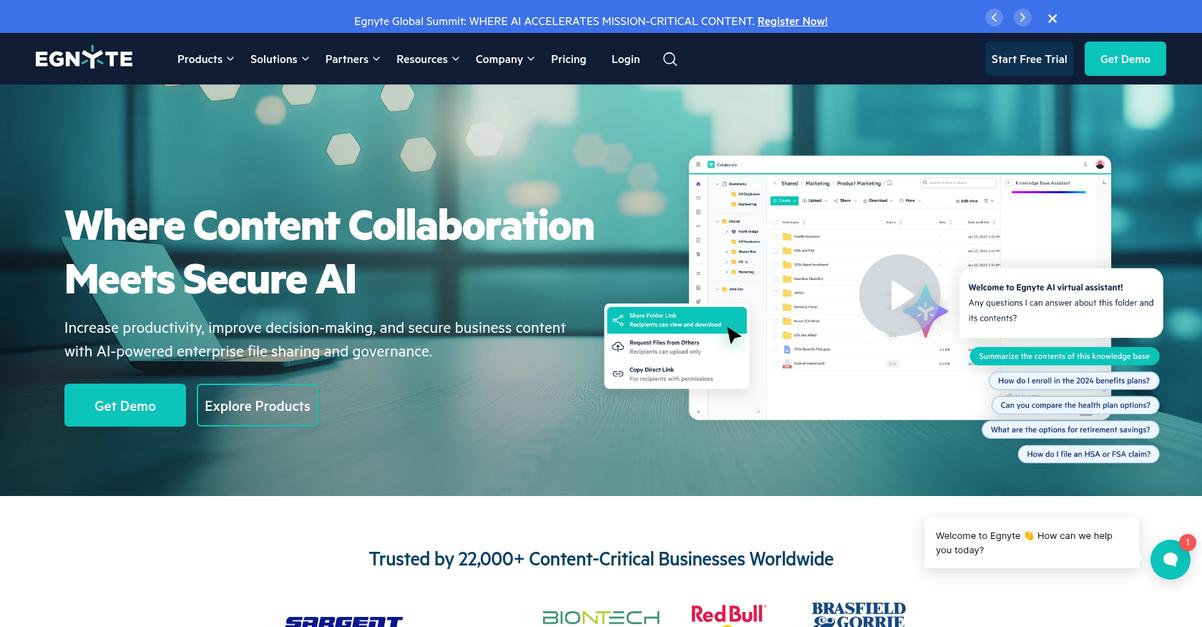

4. Egnyte

Looking for better compliance than Tailride delivers?

Egnyte tackles document management in finance with centralized content governance, comprehensive auditability, and industry-specific compliance, areas where Tailride shows real gaps for regulated teams.

If you need regulatory safeguards that go far beyond invoice automation, Egnyte is purpose-built for finance workflows requiring airtight controls. You’ll get peace of mind on compliance management that Tailride just doesn’t provide.

Here’s how your audit risks shrink instantly.

Egnyte steps in by letting your team centralize all financial documentation—statements, contracts, sensitive client files—under strict data governance and retention policies. No more compliance anxiety or digging for evidence across scattered systems.

You also gain industry-grade regulatory coverage for FINRA, SOX, and SEC rules right out of the box, something missing from Tailride. That means your auditors see real-time controls and automated trails, not just invoice histories.

Even better, Egnyte’s permissions and encryption allow fully controlled sharing with outside parties. You get robust external collaboration minus the security headaches that can come with Tailride’s narrower portals.

That translates into audit-ready preparation every month.

Key features:

- Centralized content governance with advanced controls lets your team manage all sensitive financial documentation in one place, applying retention, access, and compliance rules for true oversight.

- Built-in regulatory compliance for FINRA, SEC, GLBA, SOX delivers industry-specific controls, so you’re always prepared for regulatory reviews—a critical step up from Tailride’s limited scope.

- Granular external sharing with encryption enables secure, controlled document access for clients and partners, addressing collaboration needs without compromising data privacy compared to Tailride portals.

Verdict: Egnyte is the smartest switch from Tailride for finance document management if you want deep compliance and audit protection. With enterprise-grade controls for FINRA, GLBA, and SOX, your team is ready for any audit, with security and workflow capabilities tailored for financial use cases.

5. GoFileRoom

Looking for more robust audit controls than Tailride?

GoFileRoom gives you advanced security, purpose-built tax workflows, and tight connections to financial systems—addressing key gaps that hold Tailride back for finance teams.

Unlike Tailride, which focuses mostly on invoice processing, GoFileRoom delivers firm-wide workflow automation for all your tax documents. This means your compliance, searchability, and record management challenges can be solved from day one.

Plus, GoFileRoom combats stress over document digitization by ensuring secure storage and audit trails built in.

Let’s dig into why this is such a game-changer.

GoFileRoom directly solves these core pain points facing Tailride users by giving your finance team specialized workflow automation and enterprise-level security right out of the gate.

Here’s how it can help you leave Tailride’s limitations behind: with ScanFlow and TaxSort, you can digitize massive amounts of paperwork fast and auto-organize it into the correct client folders—no more tedious manual sorting.

Additionally, the advanced access controls, flexible retention rules, and detailed audit trails mean you never have to worry about compliance gaps or missing documents during an audit. Multiple features work together so your accounting process is streamlined and fully protected.

You finally gain peace of mind on compliance and efficiency.

Key features:

- Integrated tax workflow automation for finance teams gives you specialized tools for tax document routing and organization, extending well beyond Tailride’s invoice processing focus for comprehensive audit prep.

- ScanFlow with automated TaxSort technology instantly converts scanned paperwork to searchable PDFs and sorts them into client folders, radically reducing manual organization compared to traditional capture solutions.

- Enterprise-level security and audit trails deliver granular access controls, flexible document retention, and transparent tracking for sensitive client data, supporting accounting regulatory compliance unlike simple automation tools.

Verdict: GoFileRoom is a top Tailride alternative if your finance team prioritizes compliance, automated tax workflows, and ironclad document security. Firms report significant audit preparation time savings and improved team collaboration, thanks to features like ScanFlow and enterprise security controls, especially when integrated into your Thomson Reuters workflow.

6. Canopy

Are Tailride’s compliance gaps putting audits at risk?

Canopy’s all-in-one practice management suite tackles the limits of Tailride by combining document storage, client portals, workflow automation, and billing, beyond simple invoice management.

Unlike Tailride, Canopy brings together your entire workflow, making it easy to maintain robust audit trails and advanced compliance in one place. This means your finance team can focus on accuracy instead of juggling disconnected tools.

Here’s why you should look closer at Canopy.

Moving to Canopy gives you a platform tailored for accounting and finance teams needing more than just invoice processing.

With Canopy, you centralize everything—from secure document storage to workflow automation and time tracking. For users frustrated by Tailride’s limited controls, you get a branded client portal for real-time communication and e-signatures, underlining seamless document exchange with airtight compliance. This makes collaborating on audits, communicating with clients, and managing financial records much more straightforward.

Additionally, Canopy’s IRS transcript integration means you can directly access crucial tax data without having to toggle between multiple systems. That single sign-on to tax client info beats Tailride’s focus on just invoice automation, empowering your team to handle tax resolution fast.

Users say the platform enabled a fully paperless environment and clients love the mobile access.

Canopy really takes things up a notch.

Key features:

- All-in-one document, workflow, and client management eliminates the need for separate tools by centralizing document storage, workflow automation, time tracking, and billing—much more than what Tailride covers.

- Branded client portal with real-time e-signatures allows secure, comprehensive client-document interactions, so you aren’t restricted to basic receipt uploads like on Tailride.

- Integrated IRS transcript access for tax professionals streamlines tax resolution and compliance directly inside the platform, a specialist feature Tailride does not offer.

Verdict: Canopy stands out as an alternative to Tailride if your finance team needs an audit-ready, all-in-one document management hub. With clients reaching a paperless setup and praising the mobile app, Canopy’s robust features deliver crucial compliance and workflow improvements your practice can count on.

7. TaxDome

Need tighter controls than what Tailride provides?

TaxDome gives you a full all-in-one platform where your documents, client communications, workflow automations, and even billing are managed together—way beyond Tailride’s basic invoice processing focus.

If you’re frustrated by limited compliance features or a lack of audit trails, TaxDome is built to centralize every critical workflow, automate tasks, and offer a secure portal for effortless exchanges and e-signatures.

Your compliance goals deserve a comprehensive approach.

Here’s how TaxDome steps up as a real Tailride alternative. You get unified practice management, a secure client portal, and automation that saves hours of tedious tasks right out of the box, all tailored for accounting and finance teams.

That means you can move all your finance operations under one roof, connecting documents, communications, and tasks so nothing falls through the cracks—unlike with Tailride’s much narrower approach.

Additionally, TaxDome empowers your entire team to collect client documents automatically, assign jobs, and track workflow status, all while keeping data secure and interactions auditable for compliance.

The result is real, measurable efficiency for your firm.

Key features:

- Unified CRM, workflow, and document management centralizes everything in one platform, covering more than just invoice processing and giving your team full operational control.

- Branded, secure client portal and native mobile app let your team and clients handle document exchange and e-signature in a modern, streamlined interface, improving communication and compliance.

- Customizable workflow automation with digital organizers handles repetitive tasks like document requests or tax prep steps, offering greater automation depth compared to Tailride’s limited scope.

Verdict: TaxDome stands out as one of the best Tailride alternatives for finance teams needing robust document management and compliance. Firms using TaxDome report a 9% efficiency boost within 12 months, thanks to all-in-one workflow and automation—proving it’s built for real results.

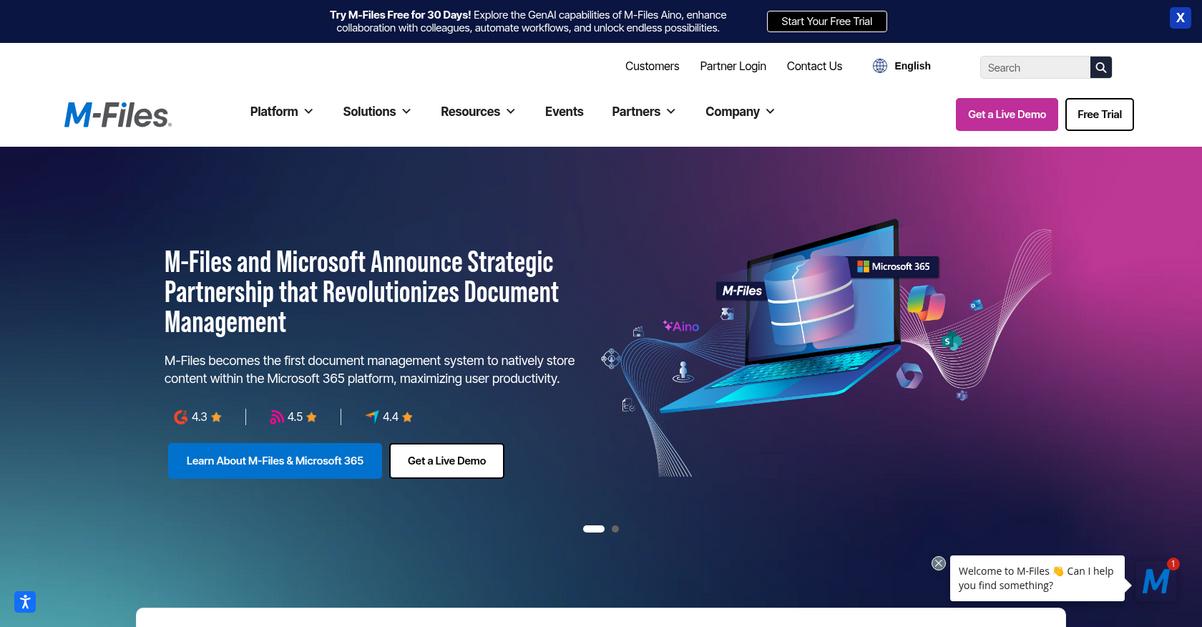

8. M-Files

Tired of Tailride’s clunky compliance and limited visibility?

M-Files brings a smarter, metadata-driven approach that tackles the root of Tailride’s limitations—especially when it comes to organizing and discovering your financial documents, managing compliance, and integrating with core finance platforms.

You’re not stuck with rigid folders; M-Files lets you organize documents by content type and context, eliminating information silos and improving audit readiness instantly. If finding financial records or proving compliance in Tailride takes too long, you’ll notice the difference fast.

Here’s where M-Files really stands out for you.

M-Files delivers next-level document management by focusing on what each document actually is, rather than where it’s saved. Plus, it connects all your data—from SharePoint to network drives—without forcing risky migrations or infrastructure overhauls.

The result? Your team’s information flows automatically. M-Files uses AI to classify financial docs, extract data, and drive custom workflows. This means smoother audits, automated approvals, and real-time compliance tracking—all without Tailride’s bottlenecks and manual workarounds.

Additionally, robust integration lets your current systems work together. Imagine unifying financial records from every source and automating audits, right away. You can improve process efficiency by up to 70% and access files in half the time, making your switch much less painful.

M-Files takes your finance workflows further.

Key features:

- Metadata-driven document organization and retrieval breaks away from traditional folder systems, so you find invoices, contracts, or compliance records by what they are, not just where they live.

- Unified access to content across all repositories connects to Microsoft 365, SharePoint, and more, allowing complete management of your financial documents without migrating everything to a new system.

- AI-powered automation for classification and workflows extracts relevant data and automates financial document processes, providing deeper automation and insight than Tailride’s focused invoice tools.

Verdict: If you’re searching for a Tailride alternative built for finance team document management, M-Files is a clear winner. Its unified, AI-driven approach has helped users boost efficiency by 70% and achieve a 294% ROI—proving critical for your compliance, audit, and workflow success.

9. Square 9 Softworks

Need stronger compliance and better audit trails?

Square 9 Softworks replaces Tailride’s rigid, limited capture with an AI-powered system that extracts data from all your financial documents, not just invoices.

This means your team can finally rely on accurate and intelligent data extraction across every type of form, ensuring compliance and record accuracy while you cut out manual error. Unlike Tailride’s narrowly focused features, Square 9 Softworks gives you automation designed precisely for complex, document-heavy accountability.

You get enterprise-level capability, without compromise.

If you’re searching for the best Tailride alternative, Square 9 Softworks is built to solve your workflow challenges for good.

It starts with AI-powered document capture that reads, indexes, and extracts information from absolutely any financial document your finance team receives. You’re no longer tethered to a single format, so audits get easier and you minimize those dreaded manual review cycles.

GlobalAction workflow automation goes a step further by letting you design and automate custom workflows for Accounts Payable, Receivable, or contract management, not just invoice routing. You can tailor workflows visually so everything fits your exact finance process, unlike the limited automations you may be used to with Tailride.

Integrate directly with your ERP or accounting platform—SAP, Sage, Dynamics, and more—creating a unified data environment where finance records always match and stay audit-ready. Your transition from Tailride unlocks real control.

Everything you need to streamline finance management.

Key features:

- AI-powered data capture for all financial documents uses generative AI and OCR-assisted indexing, enabling accuracy and compliance far beyond Tailride’s invoice-only capabilities for financial recordkeeping and audits.

- Enterprise-grade workflow automation for finance processes with GlobalAction, giving your team customizable, visual process design for AP, AR, and contract management rather than one-size-for-all invoice workflows.

- Seamless ERP and accounting system integrations with core platforms like Sage, SAP, and Dynamics, providing a truly unified financial data environment instead of the limited accounting tool connections offered by Tailride.

Verdict: Square 9 Softworks is a powerful alternative to Tailride if your finance team needs full-spectrum compliance, deeper ERP integration, and advanced automation. Users have seen workflows worth $18,000 achieve ROI in 3 months and eliminate hours of manual entry, making audit prep a breeze.

10. PaperLess Europe

null

Problems with Tailride holding back your finance workflow?

PaperLess Europe targets these pain points with AI-powered invoice data capture, automated purchase order matching, and real-time synchronization with Sage, Xero, or SAP Business One.

Where Tailride often falls short in compliance and integration, PaperLess Europe gives you critical PO matching, deep ERP integration, and real-time validation that directly address your audit, accuracy, and automation concerns.

You won’t be stuck with the same old limitations.

Here’s how PaperLess Europe steps up as a genuine Tailride alternative.

If you’re looking to really automate your AP process, PaperLess Europe makes it happen by auto-extracting invoice data at both header and line levels using intelligent AI—no more error-prone manual entry.

What sets it apart is live posting and instant access inside your accounting software so your team stays in control without switching between multiple systems. You get a smoother workflow and fewer data errors compared to Tailride.

Additionally, the automated PO matching takes away the hassle of chasing paper trails or reconciling mismatched invoices and purchase orders. This all-in-one workflow saves you time, improves audit confidence, and makes onboarding much less risky if you’re used to Tailride’s fragmented tools.

Better finance audits start with smarter automation.

Key features:

- AI-powered invoice recognition at header and line level delivers more accurate and detailed invoice data extraction, eliminating manual input far beyond Tailride’s receipt automation capabilities.

- Automated PO/invoice matching for Accounts Payable ensures every invoice is validated against purchase orders and deliveries, tackling a key AP need that Tailride often overlooks.

- Deep integration with Sage, Xero, and SAP B1 brings real-time posting, lookup, and automated archiving directly into your core accounting software, boosting your compliance game and audit readiness.

Verdict: PaperLess Europe stands out as a robust Tailride alternative for finance teams craving deeper automation and true audit readiness. With teams reporting a 95% speedup in invoice retrieval and 85% less manual data entry, you’ll see efficiency soar without sacrificing compliance or integration.

Conclusion

Ready to break free from Tailride’s shortcomings?

It’s common to get tired of weak audit trails or awkward integrations that just don’t line up with your finance workflows. When you can’t count on your document system, audits and compliance become way more stressful than they need to be.

Moving away from familiar tools is never easy, but staying stuck in a workflow that drains your team costs you more time and peace of mind with every audit cycle.

Let’s get you on the right track.

Of all the alternatives I tested, FileCenter is easily my top pick to replace Tailride. It handles compliance, organized filing, and system integration with less friction and more flexibility.

Many finance teams find that switching to FileCenter streamlines their daily work because it’s built for robust financial/ERP processes—making this move a clear upgrade compared to Tailride.

Try FileCenter out—start a free trial and see the difference.

You’ll regain audit confidence and control.